Environment, Social and Governance (... and Tax)

Welcome to the 2025 joint tax seminar webpage of the Universities of Ferrara, Budapest "ELTE", Heidelberg and Prague. The two-day event will be dedicated to the impact of tax policies beyond revenue collection for the state and the use of fiscal tools to stimulate sustainable growth and inclusive policies.

Taxes may stimulate behaviours, promote lifestyles, and meet people's necessities regarding housing, family protection, etc. Yet, pursuing these goals has to be consistent with the ability to pay principle and other constitutional constraints on the power to tax as ruled by the domestic constitution and EU law. The seminars shall investigate these limits and illuminate the new way of addressing European taxation.

More info to come.

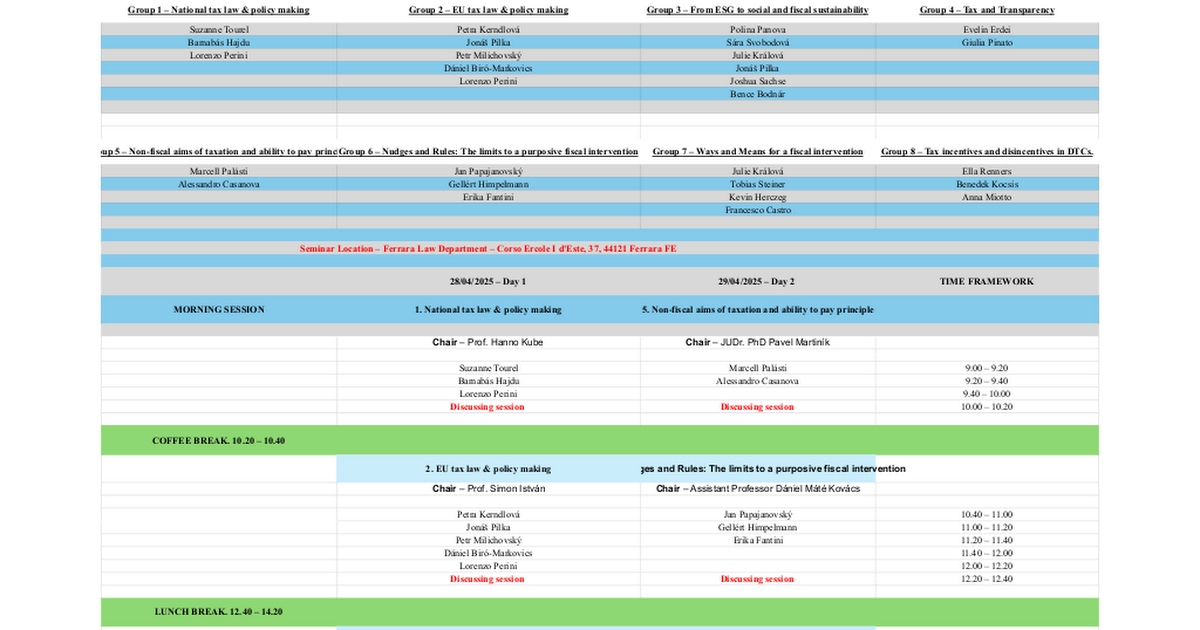

Day 1 - 28 April 2025

Assessing the Impact of ESG Criteria on the Sources of Law

Session 1.1 -

National tax law & policy making

Suzanne Tourel

Barnabás Hajdu

Lorenzo Perini

Session 1.2 -

EU tax law & policy making

Petra Kerndlová

Jonáš Pilka

Petr Milichovský

Dániel Biró-Markovics

Lorenzo Perini

LUNCH BREAK

Session 1.3 -

From ESG to social and fiscal sustainability

Polina Panova

Sára Svobodová

Julie Králová

Jonáš Pilka

Joshua Sachse

Bence Bodnár

Session 1.4 -

Tax and Transparency.

The duty of disclosure and the duty not to embark on aggressive tax planning operation

Evelin Erdei

Giulia Pinato

Day 2 - 29 April 2025

Taxation beyond Finance

Speakers

Session 2.1 -

A delicate balance: Non-fiscal aims of taxation and the ability to pay principle

Marcell Palásti

Alessandro Casanova

Session 2.2 -

Nudges and Rules: The limits to a purposive fiscal intervention

The case of housing. Tax history and experience in incentivising and disincentivising residential building.

Jan Papajanovský

Gellért Himpelmann

Erika Fantini

LUNCH BREAK

Session 2.3 -

Ways and Means for a fiscal intervention: exemptions, accelerated depreciation, super deductions, non-deductibility, refundable and non-refundable credits, and special tax rates.

Julie Králová

Tobias Steiner

Kevin Herczeg

Francesco Castro

Session 2.4 -

Tax incentives and disincentives in DTCs.

How tax treaties transport ethical imperatives across borders.

Benedek Kocsis

Anna Miotto

Ella Renners

Venue and Logistics

Department of Law - Corso Ercole I D'Este, 37 - Ferrara - Italy