Quirinal Treaty Series Seminars on Taxation: Wealth energy and Bilateral Development

10 and 11 March 2023, Univesity fo Ferrara, Rovigo Campus, Palazzo degli Angeli

Under Article 5 (1), Treaty of the Quirinal "Les Parties encouragent les échanges entre leurs acteurs économiques en veillant à promouvoir une croissance équitable, durable et inclusive. Elles s’engagent à faciliter les investissements réciproques et portent, dans un contexte d’équilibre de leurs intérêts respectifs, des projets conjoints pour développer les entreprises innovantes, les petites et moyennes entreprises et les grandes entreprises des deux pays, en favorisant leurs relations réciproques et la définition de stratégies communes sur les marchés internationaux, dans le cadre d’une Europe sociale".

Taxation is a key factor in such improvement of bilateral relations. The Department of Law of the Universities of Lyon III and Ferrara has initiated in 202 the firs to a series of seminars "The Treaty of Quirinal Seminars" whose aim is to promote and simulate reciprocal understanding, in the spirit of the Treaty.

The second seminar is going to be held on March 10th and 11th at the University of Ferrara, Rovigo Campus. The war in Ucraine is urging EU member states to find ways and means to raise the revenue needed to address it. The attention turns to wealth taxation, energy taxation and windfall profits. Will it be enough ?

More info Soon.

Final Programme

---

10 MARCH (Friday)

MORNING 10.00 - 13.30

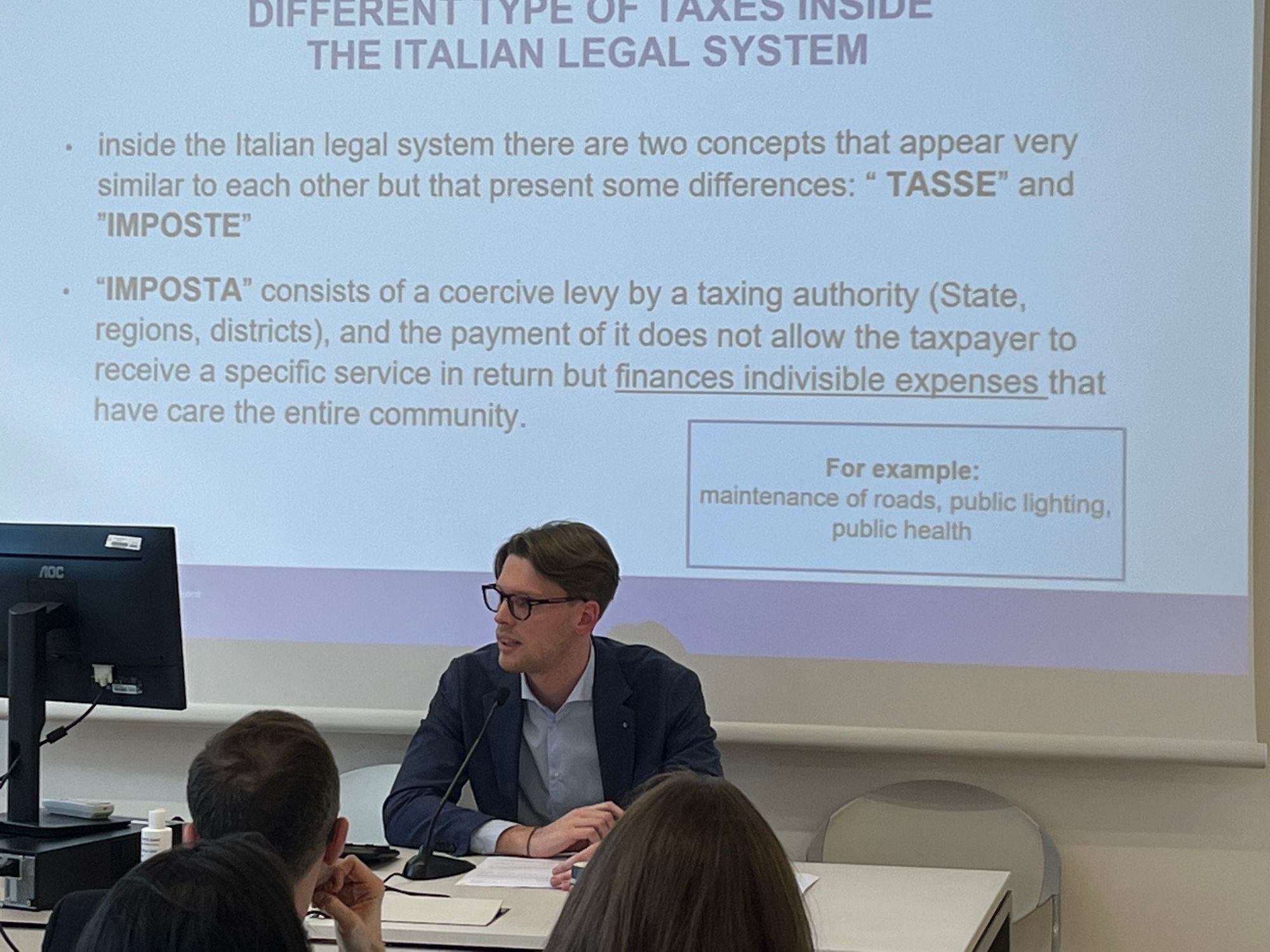

WINDFALL PROFIT TAX (Rovigo)

- Group (1 hour) → What is a WPT ? A tax on income ? What is the tax base ?

Anass BENABDELLAH ;

Mehdi SAHRAOUI ;

Pierre SALLET ;

Charlotte VELON;

Vittoria NEGRI. - Group (1 hour) → Tax policy Fairness of the tax consistency with the Constitution

Karine LIMAL ;

Farah KHALDOUNE ;

Clémence REYDELLET (distanciel);

Anna SCARAZZATI. - Group (1 hour) → EU Regulation in the matter

JOLY Melvyn;

MARTIN BILLON Manon;

MARQUES Paul;

Rebecca PAVAN.

Discussion (30 minutes)

AFTERNOON 15.00 - 18.30

WEALTH TAX (Rovigo)

- Group (1 hour) → What is wealth ? Movable ? Immovable ?

Sana AKKAOUI;

Elise BOUTON;

Sasha KAZADO (distanciel);

Fabio MARTELLO;

Enrico BARTELLE. - Group (1 hour) → Conflict with property rights and article 1 first protocol ECHR

Tancelin EMORINE ;

Marie CHABANNES ;

Julien MORIAU ;

Rayan CHIBANE ;

Sabri YAHIAOUI. - Group (1 hour) → Cases of wealth tax ? Or wealth tax in the OECD Model convention

Marvin BONIOL ;

Alperen BAYRAKCI;

Ian LEIVA;

Klaudija KIRKILAITE' LIBONI. - Filippo Luigi GIAMBRONE

Discussion (30 minutes)

11 MARCH (Saturday)

MORNING 10.00 - 13.30

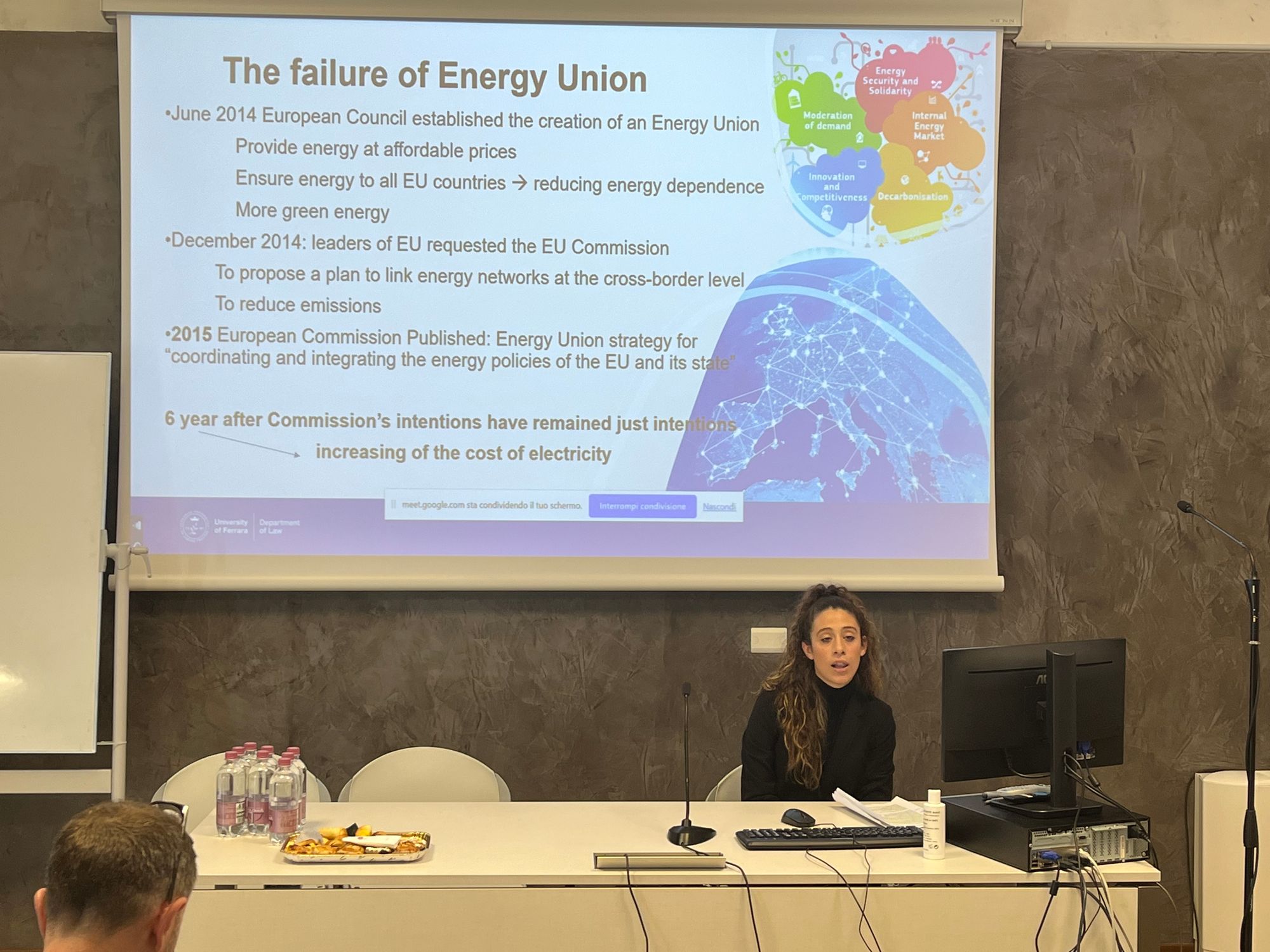

ENERGY TAXATION (AND CARBON BORDER TAX ADJUSTMENTS) (Rovigo)

- Group (1 hour) Energy taxation and the legal framework for CBTA: the French experience and innovation. State of the art

Mathis DEFOORT (distanciel);

Nikola TRIFKOVIC (distanciel);

David JARICOT (distanciel);

Simone SANGUIN. - Group (1 hour) Continued: Italy

Simon LUCCHIARI ;

Hugo KORSOUGNE ;

Marie FURET (distanciel);

Sarah CORSO. - Group (1 hour) The EU framework and the Green deal action plan. Cross border issues of energy taxation. The failure of the unilateral approach

Bertille TOUZET (distanciel) ;

Théo GALINA;

Julie GILLARD (distanciel);

Elisa GENILLON (distanciel);

Elena GARBIN;

Mattia ZAGO.

Discussion (30 minutes)

MATERIALS

#taxtwitter All good things come to an end (too soon). Farewell today at #rovigo campus of Università degli Studi di Ferrara. We said "au revoir" to the French delegation from the Université Jean Moulin (Lyon III) after two intese days of discussion on en…https://t.co/Y7zIsSQl0z

— Marco Greggi (@marcogreggi) March 11, 2023

Up above, the second day in Rovigo, here below the first one