Taxation and Globalization Adapting Tax Policy to Covid-19: Evidence from Israel

University of Ferrara and Zefat Academic College joint seminars

Ferrara, 24 February 2022 - Corso Ercile I D'Este, 37 - Ferrara, Italy

15.00 - 16.00

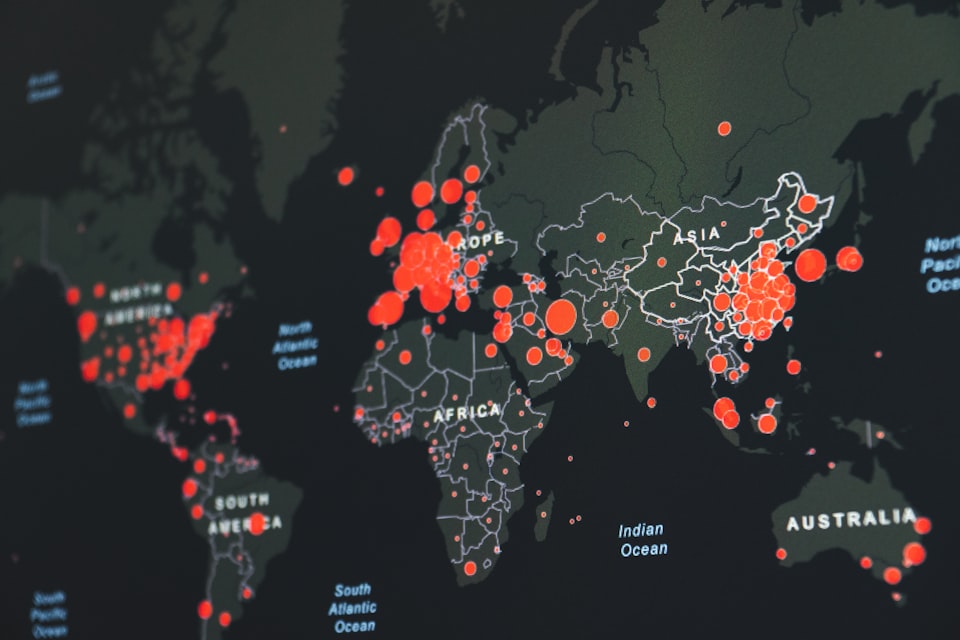

The entire world is striving to overtake the Covid-19 challenge, yet states’ response varies, from the Chinese zero-tolerance approach to the American progressive relaxation of constraints. European states follow different paths, consistently with their priorities and the political agendas of the different majorities in the Parliaments.

Israel followed from the very beginning a unique approach in this respect, being one of the early adopters of the vaccine policy and pursuing it till the very end with a fourth jab for all the population.

As health emergency seems to phase out, the economic one is rising and with that the need for a different understanding of taxation and a new approach to fiscal policy. International aspects are no stranger to this.

Nelle Munin, Professor of tax law at the Zefat Academic college (IL) inaugurates the recent Academic agreement between University of Ferrara and the Zefat Academic college with lecture on the Israeli doctrine on taxation and on the changes needed to collect new resources, address inequalities, and boost a sustainable growth.

Join us here.