Italy, Malta and Taxation

April 5th, 2022 15.00 – 18.00 (Rovigo)

April 8th, 2022 14.00 – 17.00 (Ferrara)

As the new crisis in the East seems to replace pandemic in the European agenda, states are still struggling to find economic resources needed to preserve the welfare and foster the domestic economies. The common understanding is that the Next Generation EU / Recovery Plan projects won’t suffice, and the long-term sustainability of the growth might be granted only via robust (and bold) fiscal policy decisions. Tax competitiveness appears to be once again (and once) more the remedy, yet EU law regulates the phenomenon and poses constraints and conditionalities.

Malta and Italy, so close to each other, seem to have adopted different legal strategies in this respect.

The purpose of this two days event, part of the PhD Programme in European Law and National Legal systems (University of Ferrara) and of the courses in tax law is to investigate the legal measures Malta has enacted to stimulate the growth.

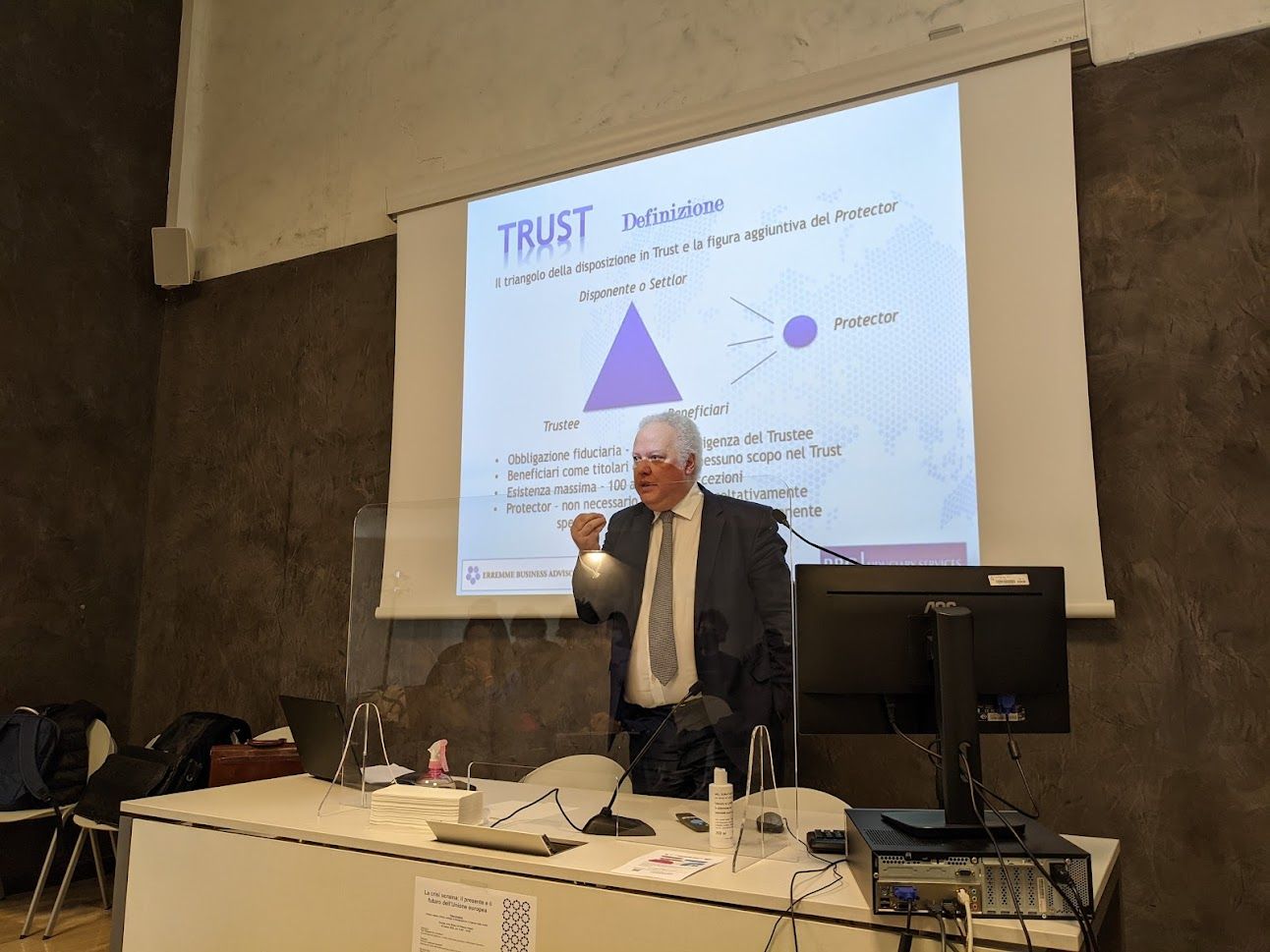

Day 1: the Maltese developments in Trust law and the Malta tax refund for Italian Shareholders.

Speakers:

Marco Greggi, Department of Law, University of Ferrara (Italy)

Edward Spiteri, Junior Lecturer - University of Malta, Malta Institute of Management, Tax Advisor, Erremme

Mr. Reuben Buttigieg, Lecturer – University of Malta, Malta Institute of Management, Managing Director, Erremme

Anna Miotto, PhD Candidate, University of Bergamo

Valentina Passadore, Research Fellow, University of Ferrara

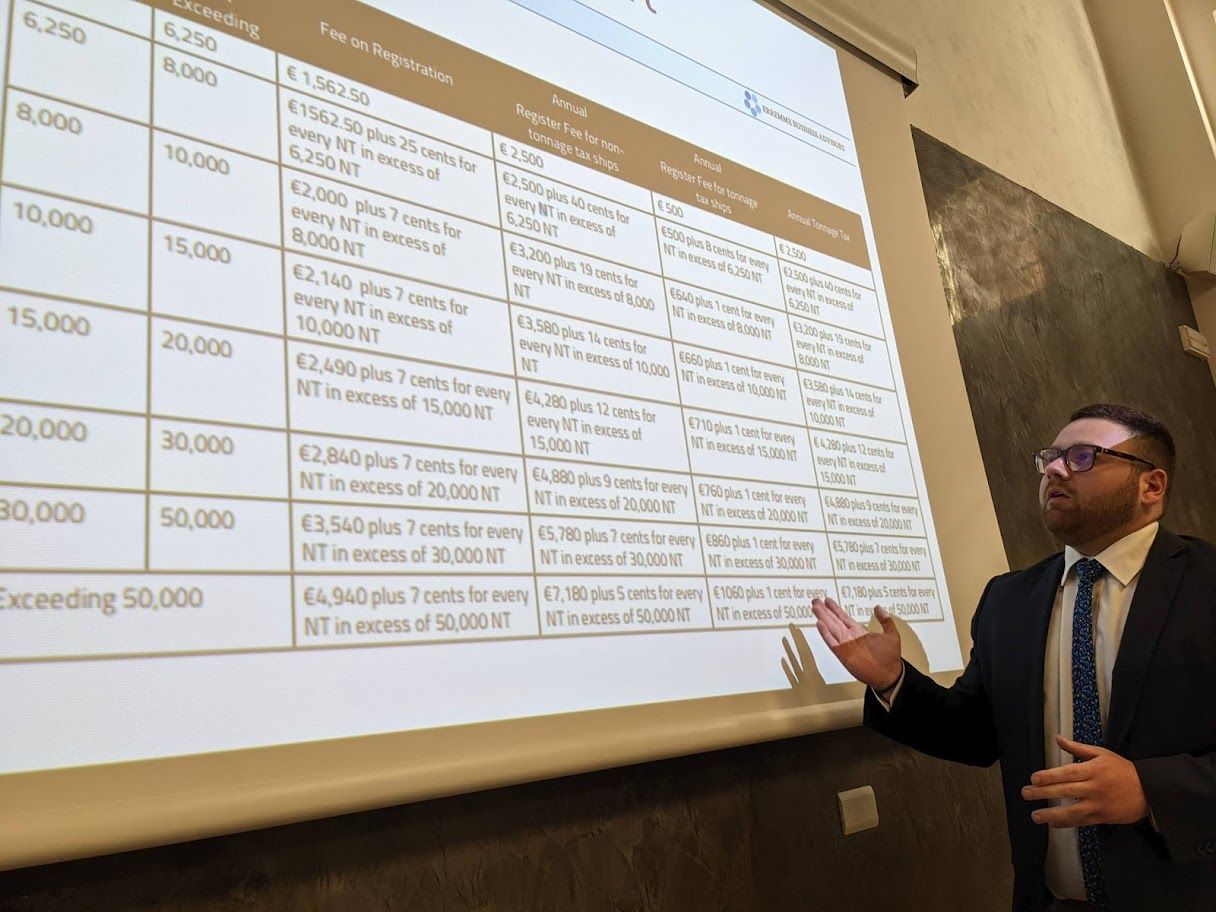

Day 2: The Nomad tax System, Malta Enterprise Tax system and the Tonnage Tax

Speakers:

Marco Greggi, Department of Law, University of Ferrara (Italy)

Edward Spiteri, Junior Lecturer - University of Malta, Malta Institute of Management, Tax Advisor, Erremme

Mr. Reuben Buttigieg, Lecturer – University of Malta, Malta Institute of Management, Managing Director, Erremme

Eleonora Addarii, Researcher University of Ferrara

Although intended for students, the event is open to other stakeholders

(Registration is needed at grgmrc@unife.it). The language of the event is English, but an asynchronous translation will be provided.

The event is possible thanks to the collaboration with the Malta Institute of Management and the University of Malta.

Here are some of the materials used during the presentations.