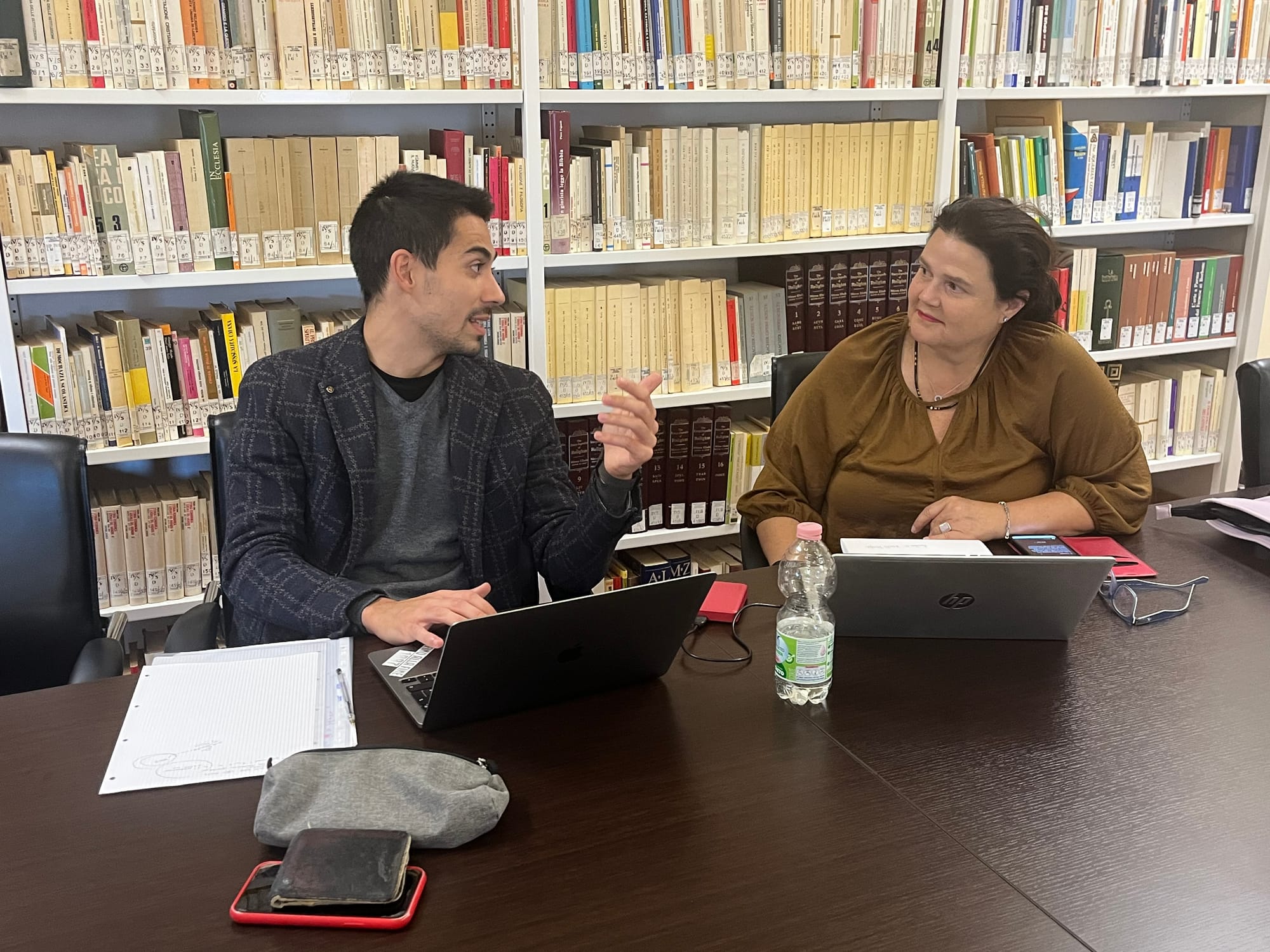

Family Wealth Protection and Taxation: the South African Case

3 October 2025, University of Ferrara (11.00 - 12.30) - in person and online.

Speaker: Professor Lizelle Ramaccio Calvino, University of Zululand, South Africa

Introduction by: Professor Marco Greggi, Univesity of Ferrara

We are glad to open the new academic year of our PhD Programme in Ferrara With a Colleague from the Univesity of Zululand, a new Partner of Unife for research and education.

The event aligns with the research priority for the new academic year: wealth protection and management. South Africa, the richest nation of the continent, is experiencing a moment of dramatic changes in terms of policy and case law.

In such a scenario, asset protection becomes crucial for households and investors. Lizelle Ramaccio Calvino, professor of Family law at the University of Zululand, shall illustrate the latest changes in the South African legislation.

Join us: online or in presence

1. Background

The legal and policy aspects of family wealth protection and transfer between generations become crucial in jurisdictions with different legal systems. The legal systems of Italy and South Africa provide essential knowledge about family wealth protection through their civil law framework with strong heir protection and on the other hand South Africa's mixed legal system which combines common law and indigenous law.

2. South African Common Law

The Trust Property Control Act 57 of 1988 serves as the main authority for trust law in South African jurisdiction which has developed a complete trust framework. Trusts function as a primary tool for South African families to protect their assets and transfer business ownership between generations. South African succession planning for family businesses depends on wills and trusts and company law rules and shareholder agreements instead of having family pact laws like Italy. The Wills Act 7 of 1953 grants South African private law its core principle of testamentary freedom which remains unrestricted except for minimal support obligations. The absence of forced heirship rules in South African law enables extensive asset distribution freedom but creates potential conflicts between family members regarding property division.

3. South African Indigenous Law

Customary law presents an additional viewpoint in this context. The system promotes family property ownership as a shared responsibility which maintains assets inside the lineage for present and future family members. The traditional succession system of the homestpersonad and family enterprises operated through a process which selected heirs who maintained the household operations. The succession system required heirs to provide financial support to dependents which integrated social protection mechanisms into the inheritance process. The constitutional reforms that introduced gender equality through Bhe v Magistrate, Khayelitsha did not alter the core concept of family wealth functioning as a shared resource between family members. The communitarian approach presents an opposing system to both the Italian civil law-based heir protection and the South African common law-based autonomy in succession planning.

3. Research Problem

Family wealth transfer between generations creates major legal and policy issues which affect both civil law and common law jurisdictions. The Italian legal system defends heir rights through forced inheritance rules and the "patto di famiglia" yet these protections restrict entrepreneurial families from adapting their succession plans. South African common law provides freedom to make wills and advanced trust structures. This however lacks specific laws to protect family businesses during succession. The indigenous law system of South Africa implements a unique approach to wealth management through its communitarian framework which focuses on family preservation and heir responsibilities. Different legal systems face a fundamental challenge because they need to reconcile the protection of heirs with the preservation of family assets and business sustainability through multiple generations.

4. Seminar Purpose and Novelty

The semminar evaluates the family wealth protection mechanisms of Italian and South African legal systems through their available instruments which enable business succession between generations under common law and indigenous law frameworks. The seminar shall showcase three distinct original aspects.

- The seminar focuses on South Africa's unique legal system which unites personal freedom under common law with communal values from indigenous law despite receiving minimal academic study.

- It combines legal aspects with economic elements and social factors of wealth transfer to link official succession rules with traditional family responsibilities.

- It compares South African succession systems to Italian structured succession tools to discover effective transfer methods which protect local laws and cultural traditions.